AMP Group last night clarified an apparent inconsistency in the 2022 net profit reported for its banking subsidiary.

On Monday the wealth management group appeared to revise the full year net profit of AMP Bank after it filed standalone accounts for the business with ASIC.

At the AMP Group profit result on February 16, chief executive Alexis George announced the bank generated a net profit of A$103 million for the 12 months to the end of December, which made the banking business the largest contributor to the group bottom line.

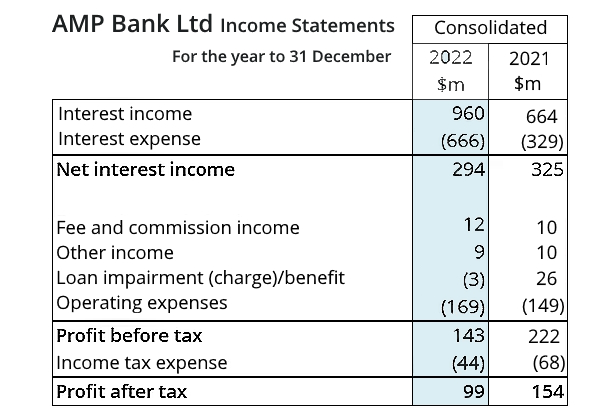

However, a profit and loss statement published in the subsidiary’s standalone accounts shows the bank recorded a statutory net profit of $99 million last year.

According to the standalone accounts, AMP Bank recorded a gross profit of $143 million before a deduction of $44 million to cover income tax.

An AMP spokesperson last night said differences between the two reported results did not constitute an accounting discrepancy, but simply reflected a difference between the subsidiary’s “underlying profit” reported on 16 February and the statutory profit reported this week to ASIC.

“The difference of $4 million is attributable to items which have been reported within statutory profit, in line with accounting standards, but which are viewed as one-off/variable for Investor Report purposes, hence excluded from this reporting,” the AMP spokesperson said.

“It is standard industry practice and consistent in approach to what AMP has previously taken, to demonstrate the underlying performance of the Bank more clearly.”

Apart from the lower bottom line result, the AMP Bank accounts contain a ream of disclosures demonstrating how the business has been repositioned strategically since George joined the group from ANZ in August 2021.

Among the most interesting disclosures are details about the risk profile of AMP Bank’s $24 billion mortgage book.

Unlike most banks, over the past four years AMP Bank has given a comprehensive view into the loan to value profile of its home loan borrowers.

Disclosures on page 40 of the accounts reveal a big change in the credit risk appetite of the bank since 2020 when one quarter of all new home lending was made to borrowers on loan to value ratios of above 80 per cent.

In 2021 high LVR borrowers accounted for 18 per cent of all new lending and in 2022 AMP lowered its credit risk tolerance to an even more conservative setting.

Only 11 per cent of new home lending written last year was made to borrowers with LVRs above 80 per cent.

While borrower composition has changed dramatically in the last 18 months, AMP Bank has continued to expand loan volumes consistently above the system growth rate.

The bank boosted the size of its home loan business by more than $2 billion last year, which equated to a growth rate of 9.6 per cent.

The de-risking of the mortgage business appears to be driving an improvement in credit quality.

AMP Bank incurred net loan impairment charges of only $3 million in 2022, despite the rapid rise in official interest rates.

That presents a contrast to 2020 when the bank suffered net impairment charges of $31 million in a benign rate environment propped by fiscal support measures that magnified the repayment capacity of borrowers.

Another big change in the banking business since George arrived at the group has occurred in way the funding mix has been managed.

In 2020 more than 40 per cent of the bank’s $16 billion deposit book at the time was sourced through AMP-related superannuation and investment platforms.

At the end 2022, the deposit book had grown to more than $21 billion, but less than 30 per cent came from the platforms.

AMP Bank was a price leader in the term deposit market for most of 2022 and this contributed to a 24 basis point fall in the net interest margin to 1.38 per cent.

However, the NIM began recovering in the closing months of the year and given further official rate rises this year is likely to rebound.

The strategic repositioning of AMP’s lending business reflects many influences, not least of which is a deliberate effort to dial down credit risk and the bank’s historical dependency on related-party deposits.

It might also be symptomatic of the competitive dynamics of the mortgage market since the RBA began tightening monetary policy 12 months ago.

According to Canstar’s Steve Mickenbecker regulated lenders such as AMP Bank have focused most of their marketing on the refinance market as the cost of credit has soared.

“The refinance market is where the volumes are being generated today and that would explain the improvement in the LVR profiles of loan books across the banking industry,” he said.

“The exodus of first home buyers has also reduced demand for home loans requiring lender’s mortgage insurance.”