Comment: Anyone offered an appointment to the main governance board of the Reserve Bank of Australia may want to be wary, with last week's report of the review into the RBA setting up thorny corporate governance headaches for the bank over the next year.

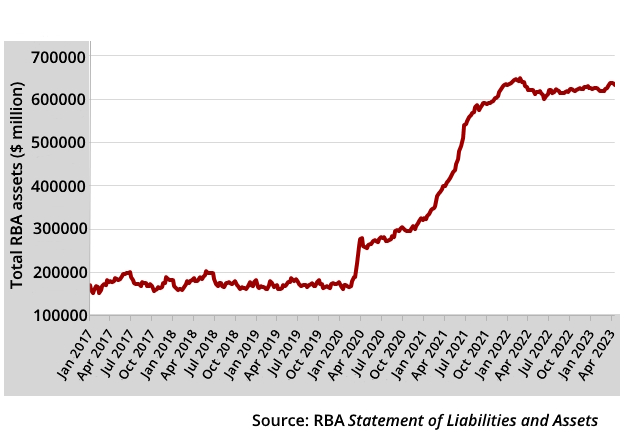

The proposed Monetary Policy Board of the RBA is being afforded extraordinary latitude to determine the composition, purpose and direction of the bulk of the Reserve Bank’s balance sheet.

Yet as things stand under the model proposed by the RBA review last week, the Governance Board of the bank will be responsible (at least overall) for the RBA balance sheet.

Given basic (and these days prescriptive) corporate governance principles, this is a baffling scenario.

The review recognises these challenges, which it resolves in a manner unlikely to satisfy governance purists.

The review considers "the use of additional monetary policy tools as an example where the responsibilities of the Monetary Policy Board and Governance Board would overlap. The Monetary Policy Board may wish to purchase government bonds to provide further support in pursuit of its inflation and employment objectives.

"This decision, however, has direct implications for the RBA’s balance sheet and risks, which would be the general responsibility of the governance board.

"In such cases, the Monetary Policy Board needs to have complete authority to take actions to meet its monetary policy goals."

To work around these dilemmas, the review proposes that "the RBA boards should establish charters setting out their responsibilities and those of the RBA executive.

"A memorandum of understanding should be established between the 3 RBA boards."

It is understood these MOUs will address these matters and no doubt this will be an intense program of work once the 3 RBA boards are in place around July 2024.

Enabling legislation to establish the Monetary Policy Board may smooth some of these bumps. (And, who knows, maybe there will be a whole new Reserve Bank of Australia Act).

The corporate governance record of the RBA in modern times is compromised by its conviction in 2011 over foreign bribery, with the wrongdoing dating from 1999.

The chapter on corporate governance in the report of the review confirms what many have long suspected: there still is not much governance actually going on, not on the part of the bank's board anyway.

"Analysis of Reserve Bank Board agendas confirms that meetings are almost entirely focused on monetary policy, with corporate governance matters appearing only occasionally,” the review says.

"Consultations with past and current Reserve Bank board members found that most members viewed the board as a monetary policy making body, with corporate governance largely falling outside their remit."

The review explains the “formal roles and responsibilities relating to risk governance are somewhat unclear, with responsibility split between the governor, the Reserve Bank Board and the Payments System Board.”

"As the accountable authority, the governor has a duty to establish and maintain risk management systems at the RBA. The Reserve Bank Board does not have an explicit statutory responsibility for risk."

Thus, "the governor [alone] sets the risk management policy, which includes the Risk Appetite Statement”.

The conclusions are then stark.

“The governor is heavily involved in monetary policy and corporate governance, effectively operating as both the Reserve Bank board chair and the CEO of the institution.”

In this context it is no surprise the review concludes that "the RBA’s corporate governance arrangements do not reflect current best practice.

"Decision making is highly concentrated in the governor with limited board oversight.”

In time, any squabbles or misunderstandings between the RBA’s two principal boards won’t count for much.

It’s always been about policy rather than profits at the Reserve Bank.