Commonwealth Bank’s award-winning banking platforms suffered a monster outage on Monday after attempts to upgrade the company’s mobile app at the weekend appeared to trigger a meltdown across its retail network.

Almost every part of the bank’s retail operation was disrupted for most of the day as technology teams struggled to resolve technical misfires, which also prevented customers at the group’s Bankwest subsidiary from conducting real time payments and transfers.

CBA’s digital services began misfiring at around 7.30 in the morning when customers reported problems logging into Netbank and the mobile banking service.

Hundreds of customers who managed to log into online services reported accounts showing balances at “zero” and no details about their home loans.

Even the telephone banking service was down all morning, with calls to the 13221 service line swiftly terminated after a recorded message alerted customers to “technical issues”.

Access to telephone banking was intermittent throughout the morning and early afternoon but appeared to normalise at around 3.30pm.

Customers also reported interruptions to branch services, with delays reported to the opening of some Sydney branches and restrictions on cash withdrawals.

CBA took a minimalist approach to communicating details about the eight hour outage to customers on its websites and social media.

The bank gave few details on its banking website about the widespread seizure of electronic services, choosing only to disclose at 8am that the protracted incident was affecting “multiple services”.

In a statement posted at midday the bank was even less specific.

“We are aware some customers are experiencing intermittent difficulties accessing some of our services and we are urgently working to resolve these issues,” the bank told customers on its website.

“Our call centres and branches are experiencing high volumes of customer enquiries at the moment due to these service issues and there may be longer than usual wait times.

“We will provide real-time information here on our service updates page as we know more.”

Customers were made to wait until after 4pm for the next “real time” update when the bank characterised the major incident as “intermittent issues that some customers experienced across our banking services today”.

The bank said that it had identified the cause of the incident but did not disclose anything more.

“We are very sorry for the inconvenience this has caused,” the bank said in the 4pm update.

CBA has marketed itself as having a core competence in digital banking and distribution.

In the last decade the bank’s mobile app and web platform have won many awards for their functionality, including multiple honours from Canstar, Forrester Research and the AFR.

However, the value of these awards needs to be questioned as they do not appear to take account of the relative access time lost at Australian banks due to internal outages.

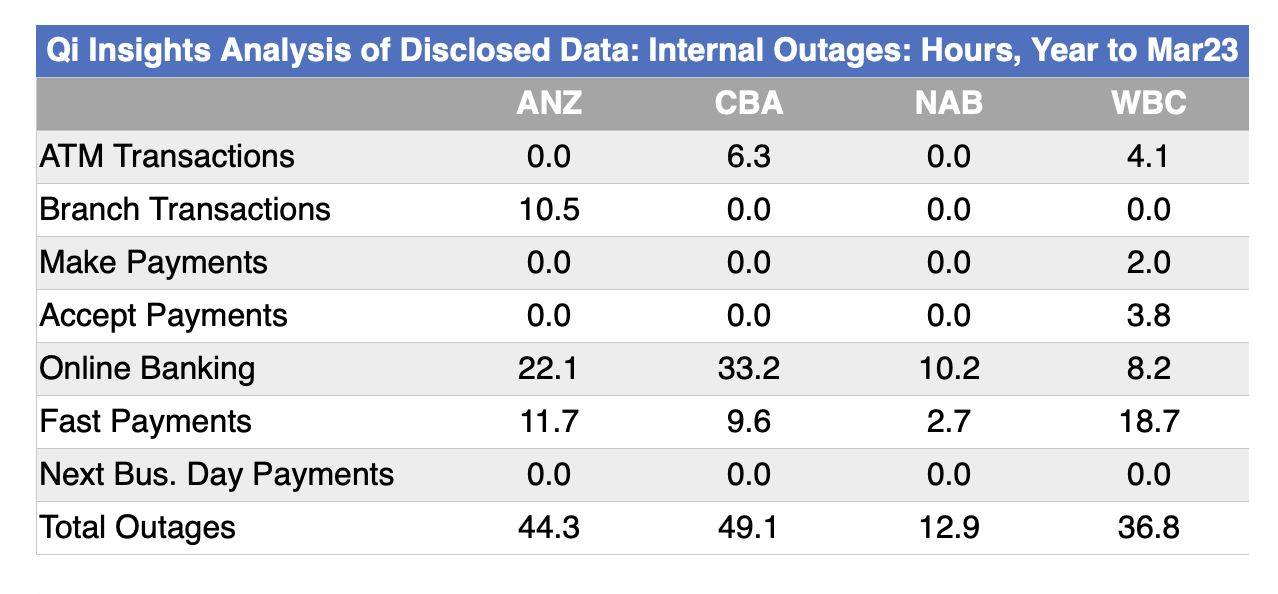

An analysis of service hours lost to internal outages by Sydney research firm, QI Insights, shows that CBA had the most unreliable distribution platforms among the major banks in the 12 months to the end of March.

The QI analysis is based on collated data disclosed by each of the major banks to the Reserve Bank.

In the 12 months to the end of March, CBA’s online banking services racked up more than 33 hours lost to outages – the worst performance of the big banks.

It also reported the most hours lost across all service channels – 49.1 hours.

“Relative to other Big Four banks, the two trouble areas for CBA over the last year are online banking and ATM transactions - where they had more outages than any other Big Four over the last year,” said Peter Drennan, managing director of QI Insights.

“With that said, CBA has been without any significant outages (enough to get reported on) in branch transactions, so today's issue, should it be classified under RBA's outline for outages, will be the first on record.

“While some outages are to be expected, the difference between Big Four banks shows what is possible - NAB recorded only 12.9 hours of outages over the year, around a quarter that of CBA.

“That is 36 hours less in outages, or around 3 hours every month.”