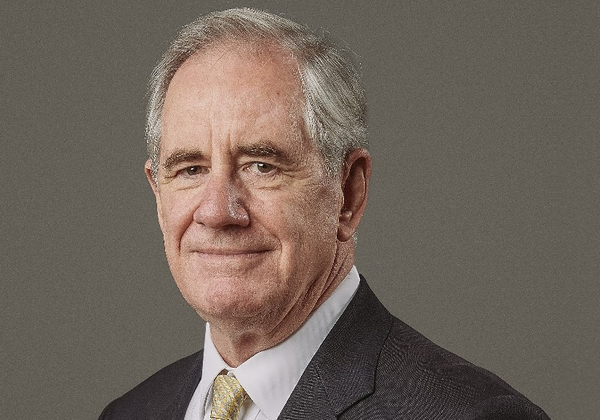

Macquarie Bank director Michael Coleman

Macquarie Group has adopted a questionable approach to dealing with the Australian Prudential Regulation Authority’s concerns about the governance of Macquarie Bank, appointing a supposedly “bank-only” director to the bank board who had just retired from the group board after a long tenure.

Macquarie reported on Friday that during the 2022/23 financial year the bank implemented a number of governance changes that are part of a remediation plan with APRA covering governance, risk culture, remuneration and group structure.

The changes include establishing separate board audit, governance and compliance, risk and remuneration committees for the group and the bank.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

Another change is the appointment of bank-only non-executive directors to the bank board. The first of these, former banker Ian Saines, joined the bank board in May last year.

Then in July, Michael Coleman, who had been on the group and bank boards for 10 years, retired from the group board and became the second bank-only non-executive director on the bank board.

Proxy advisers recommend that non-executive directors should retire after nine or 10 years on a board because they are likely to have lost their effectiveness and their capacity to be independent of management over that time. Singapore has recently introduced an exchange regulation that limits the tenure of independent directors to nine years.

According to the ASX Corporate Governance Council’s Principles and Recommendations: “The mere fact that a director has served on a board for a substantial period does not mean that the director has become too close to management or a substantial shareholder to be considered independent. However, the board should regularly assess whether that might be the case for any director who has served in that position for more than 10 years.”

Ashurst Consulting says best proactive board succession planning includes what it calls a “three by three-year tenure approach” – that is, three consecutive terms of three years and then retirement.

Coleman probably should have retired from both the group and bank boards last year. To suggest that he is an appropriate “appointment” to the bank board as one of its new bank-only non-executive directorships established under a remediation plan is questionable.

A third bank-only non-executive director is to be appointed to the bank board under the remediation program. Before that appointment is made, Macquarie chair Glenn Stevens should explain why Coleman was considered a suitable bank-only non-executive director.

Macquarie’s banking and financial services division contributed earnings of A$1.2 billion to the group for the year to March 2023 – an increase of 20 per cent over the previous year. Deposits increased by 32 per cent to $129 billion and the home loan portfolio grew 21 per cent to $108.1 billion.

The BFS impairment charge was $24 million, compared with a $22 million benefit the previous year.