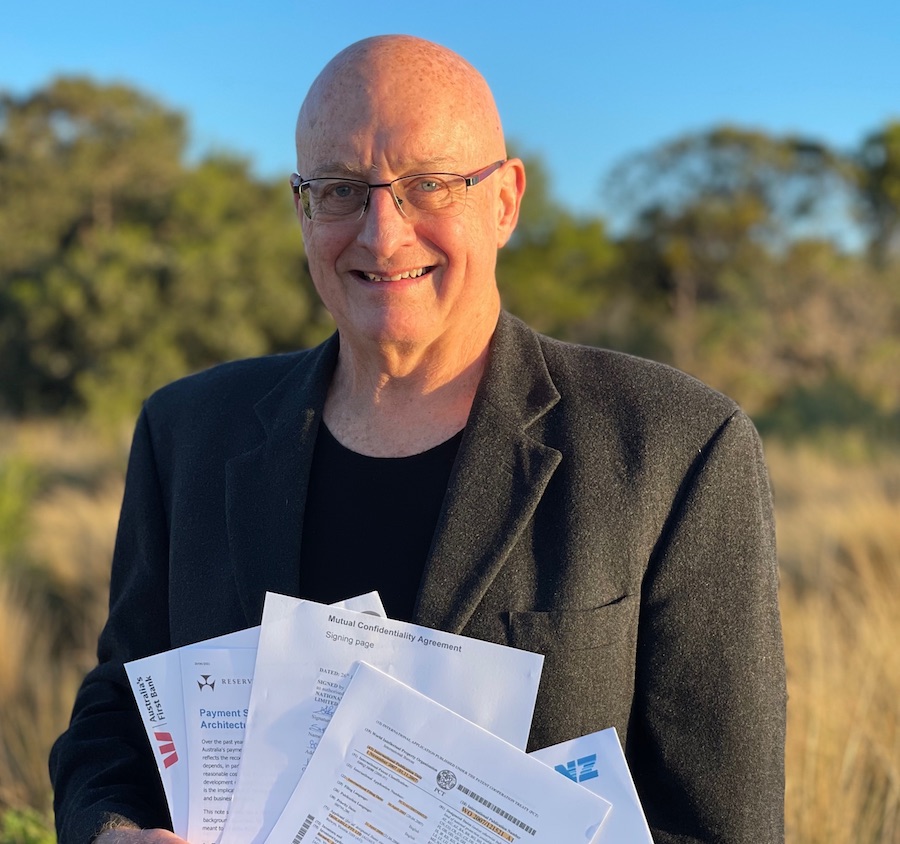

Mandated payments patent holder Stephen Coulter

A legal battle has erupted over the Australian Competition and Consumer Commission’s approval of the three-way merger of NPP Australia, Eftpos and BPay, after a local fintech filed a claim with the Australian Competition Tribunal for the decision to be suspended.

Controlabill, the Sydney-based company that holds patents to a process for providing mandated payments, applied to the tribunal on 30 September for the merger approval to be reviewed on grounds that NPP Australia (NPPA) is now operating outside of undertakings previously given to the ACCC not to develop overlay services through its payments platform.

NPPA is currently developing a mandated payments service - otherwise known in the industry as a “pull payments” service - that is expected to be launched in the middle of next year.

NPPA has branded the new business as “PayTo”.

Pull payments occur when payees or billers withdraw or “pull” money from customers’ accounts after they secure a standing authority or mandate to initiate such transactions.

Controlabill claims in its application that NPPA is in breach of its patents over a mandated payments process and that NPPA could use the newly formed merger entity – Australian Payments Plus Limited (AP+) – to “get around” restrictions on its ability to develop overlay services.

“NPPA gave the ACCC assurance that it would not develop overlay services which we believe has been broken,” Controlabill tells the tribunal in its application.

“We asked the ACCC whether there(sic) the rules that will govern AP+ would be the same.

“This was not analysed.

“The inception of AP+ may be means of getting around the NPPA restrictions on the development of overlay services.”

In an interview with Banking Day in June, Controlabill founder and former major bank executive Stephen Coulter warned that all NPPA shareholders would be infringing his company’s patents if the NPP’s mandated payments service was rolled out.

Coulter also said that major banks had signed non-disclosure agreements before talking to Controlabill about its patented payments process.

Controlabill’s legal action in the competition tribunal has been challenged by lawyers from King Wood & Mallesons (KWM) acting on behalf of Robert Milliner in his capacity as chairperson of the industry committee that earlier this year lodged the merger application with the ACCC.

KWM applied to the tribunal on 6 October for Controlabill’s action to be dismissed on grounds that it does not have “sufficient interest” under the Australian Competition and Consumer Act to challenge a merger determination of the ACCC.

“The primary grievance raised by Controlabill in its application concerns allegations of patent and copyright infringement and is not apt to be determined in proceedings before the Tribunal,” KWM told the tribunal in a written submission.

“The issues raised by Controlabill relate to a dispute with one of the parties to the merger.

“Controlabill does not identify a coherent theory of competitive harm or public detriment which is specific to the amalgamation itself.

“There is also a concern, having regard to the basis of Controlabill’s application and the evidence before the Tribunal, as to whether the proceedings are being pursued for a collateral purpose.”

Following a directions hearing of the tribunal on Friday, Controlabill and the industry committee have been ordered to furnish evidence on whether Controlabill holds “sufficient interest” to challenge the ACCC decision.

In its submission to the tribunal, KWM described the industry committee as an “unincorporated association”, but ACCC records show that the official entity that applied to merge the three payments schemes was a registered company known as Industry Committee Administration Pty Ltd.

ASIC records show NPP Australia Limited as the sole shareholder and ultimate holding company of Industry Committee Administration Pty Ltd.