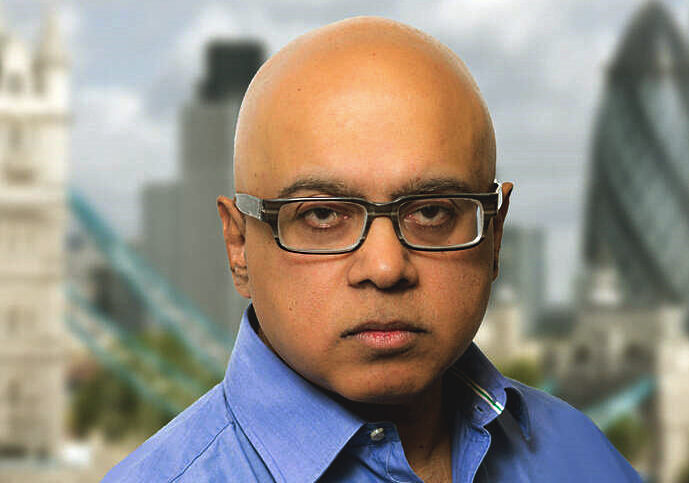

Boe Pahari, CEO, AMP Capital

Comment

There is a troubling but healthy debate happening on the state of corporate governance in Australia, framed in national media around the internal ructions at AMP over the elevation to senior management of Boe Pahari as the head of AMP Capital.

As the AFR’s recent reporting reminds AMP stakeholders, this promotion was agreed with no hindrance from the history that he had been disciplined (and fined) following a sexual harassment claim brought by a female staffer.

The case has raised more than a few eyebrows given that AMP was an organisation that just over two years ago was being hammered by the Hayne Royal Commission legal team for charging clients fees for no service, and also having some interesting ideas on what might constitute an independent report that went to the corporate regulator.

It has also raised eyebrows because in corporate governance, tone matters. Tone is everything. Tone gives people in staff ranks license to test the limits of behaviour in certain situations.

This appointment of Pahari has been criticised by a range of people not just because it looks counterintuitive given the facts presented in the media, but because it appears to contravene the fundamental values statement that the company has in its 2019 annual report.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

“AMP encourages a respectful, diverse and safe workplace that supports the physical and psychological safety of our people,” the annual report informs readers.

Those words are fine and there is work the AMP is doing on related issues, such as psychological, first aid and inclusion. But how does this issue of a respectful workplace as stated in their 2019 report fit with the appointment of Pahari given the disciplinary action?

Words must mean something and corporate governance statements also should contain sentiments that the company lives and is seen to live.

It is questionable whether all of the sentiments in that one line from the annual report cited above have been reflected in the promotion that has been the subject of attention.

How on earth did this tone deafness unravel so soon after the embarrassment that the AMP suffered during the Hayne Royal Commission when one board member after another fell on their sword.

The royal commission exposed AMP as one of the biggest rip off merchants; willing to charge fees for no service and play ping pong with a law firm in a process that wound up with a report being sent to ASIC that was characterised as independent.

It is clear that some financial services businesses really need to have a good look at the Finance Sector Union’s recent report on the culture of the banking sector, Justice Tempered. This was the work of three academics from the University of Divinity’s Religion and Social Policy Network.

That report sets down in stark terms the fact that employees of financial institutions believe in being good and fair to their customers, which is typically what the codes of conducts of these joints that swindled money from Australians state.

Employees that responded to the researchers involved said that they felt comfortable with the written code of conduct but not the actual actions that were taken by management to force sales. Staff were embarrassed by managers who were effectively behaving like thugs to get them to sell more.

Performance management and termination awaited those that were seen as underperformers - even after being hauled up in front of colleagues for failing to meet targets – and despite the fact that failing to meet those targets might also reflect the teller or other staff member was operating with a moral compass that was more in tune with community expectations.

The FSU research was focused on the welfare of the staff working within a bank and not just the customer experience and the AMP example is a classic case of people not looking at what staff might expect in circumstances such as these.

AMP’s board of directors and senior management might like to reconsider the FSU’s report and ponder their experience before the Hayne Royal Commission.