The Reserve Bank’s Payments System Board yesterday signalled it will mandate the rollout of least cost routing services by Australian banks unless they lift their performance by the middle of next year.

Australia’s four major banks made little progress rolling out least cost routing services to merchants in the six months to June, according to the latest data published this month.

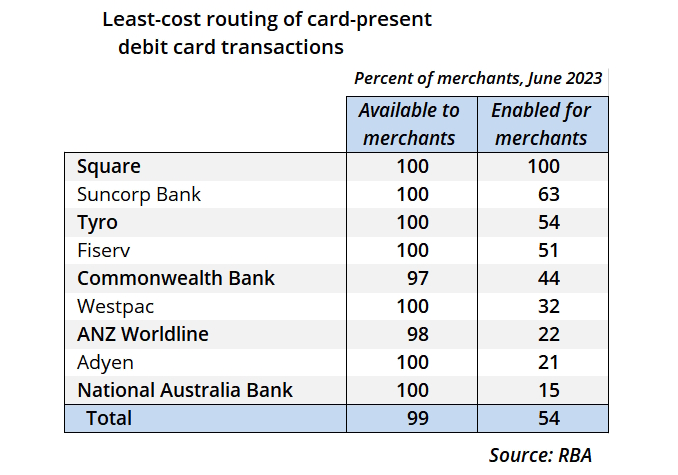

Data collated by the RBA shows that merchant customers of National Australia Bank are the least likely to garner savings from the service, which delivers lower fees on the processing of contactless debit transactions.

The RBA has repeatedly called on the banks to expedite their LCR programs to help small businesses lower the cost of accepting contactless payments.

Least cost routing is a simple service that allows retailers to select the payments platform that processes the contactless transactions they accept.

The major banks have traditionally directed such payments to Visa or Mastercard, which the RBA has found levy higher average fees on merchants than the Australian-owned Eftpos network.

LCR allows retailers to select the Eftpos network to lower their acceptance costs when customers make a contactless payment.

The latest RBA data shows that only 15 per cent of NAB’s merchant base was able to activate least cost routing at the end of June.

This is only a marginal improvement on NAB’s activation rate at the end of December last year when only 14 per cent of the bank’s merchants had LCR up and running.

NAB, which consistently promotes itself as Australia’s leading small business bank, is the industry’s laggard for delivering lower fees through LCR.

Its performance is dwarfed by Suncorp which has activated LCR for 63 per cent of its merchant customers.

Tyro, a pioneer of LCR in the Australian market, has 54 per cent of its merchant base independently routing contactless debit transactions to their preferred payments platform.

While ANZ performed better than NAB in the June half by enabling LCR for 22 per cent of its merchants, the bank appears to be failing to meet its public pledge to help more customers lower their fees.

At the end of December last year, at least 23 per cent of ANZ’s merchant base was using LCR.

Following its bi-monthly meeting in Sydney on Thursday, the Payments System Board issued a warning to the banks.

“The industry has not made sufficient progress in enabling LCR for online transactions, with only a few providers making LCR widely available to their merchants for online transactions,” the PSB observed.

“The board expects providers to make faster progress on enabling LCR for merchants that could benefit from it.

“If substantial progress is not made by June 2024, the Bank will explore a formal regulatory requirement to enable LCR.”

Despite issuing the regulatory warning and reiterating its concerns about the slow LCR rollouts, the PSB said it would no longer be considering action to prevent the banks from setting a default routing network on dual-network debit cards.

The PSB said that industry feedback from a recent consultation indicated that introducing a ban on such practices could result in failed transactions and require costly reissuance of all debit cards.

This is a controversial decision that is almost certain to trigger criticism from supporters of competition in the payments industry.

It also appears to rule out the prospect of existing debit cards being progressively replaced over time with features that enable competition rather than thwart it.

The PSB decision appears to ignore the fact that most debit cards are replaced every four years when they are usually re-designed by issuers.