Macquarie Bank appears hellbent on continuing to build market share across its mortgage lending business this year following a decision to cut the cost of most of its variable rate home loans.

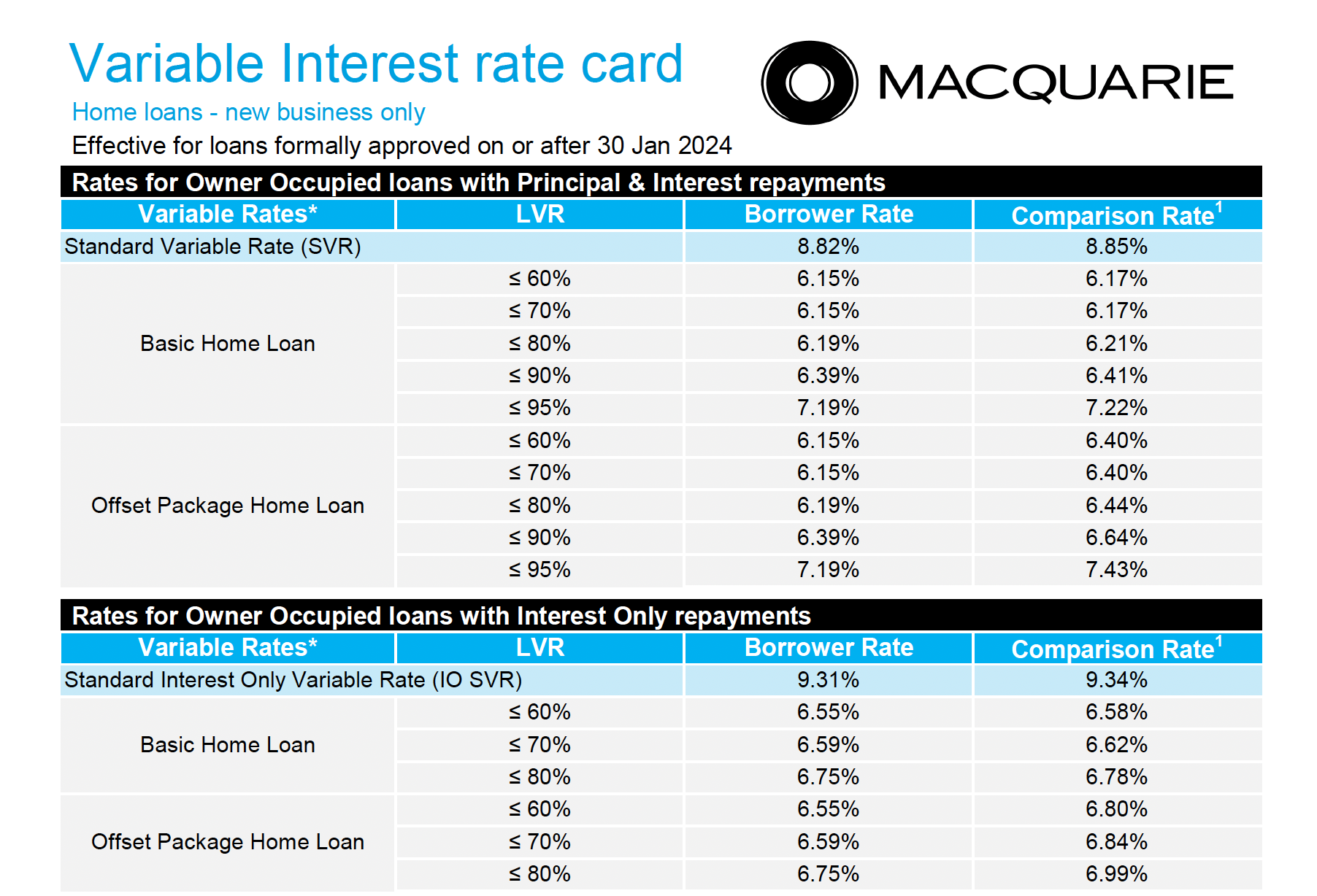

The bank issued a new rate card to mortgage brokers on Monday that includes cuts of up to 21 basis points on basic variable and offset home loans marketed to owner occupiers paying principal and interest.

The out-of-cycle rate cuts, which take effect this morning (Tuesday 30 January) include reductions across Macquarie’s suite of “Basic” and “Offset” variable mortgages in all loan to value ratio bands.

Macquarie has been Australia’s fastest-growing home lender in the last five years and the bank’s market share gains appeared to swell in the December half when other leading mortgage providers such as CBA stepped away from intense price competition to manage their margins.

Macquarie’s largest cuts are earmarked for new borrowers in high LVR bands.

New home borrowers requiring between 80 per cent and 90 per cent finance for their purchase are being offered a rate of 6.39 per cent.

This represents a 21 basis point cut and applies to customers who choose either a basic or offset package loan.

Borrowers requiring more than 90 per cent of their home purchase to be funded through their loan will pay 7.19 per cent – 11 bps lower than the previous offer.

Macquarie borrowers with larger deposits on their homes are being offered rate reductions of up to 11 basis points on new P&I loans.

The rate on loans with LVRs of between 60 per cent and 70 per cent has been reduced by 9 bps to 6.15 per cent, while loan applicants in the next band (up to 80 per cent) will pay 6.19 per cent (11bps reduction).

Macquarie has also lowered rates on interest only loans for owner occupiers by an average of 10 basis points.

The repricing of variable rates follows the bank’s move earlier this month to slash fixed rate mortgages.

Macquarie sliced its 5 year fixed rate for owner occupiers with LVRs under 70 per cent by 50 bps to 6.25 per cent last week.

The bank enjoyed a bumper end to 2023 after it wrote almost A$5 billion of new mortgage business in October and November.

Around 20 per cent of all Australian mortgages written in October and November were completed by Macquarie.

APRA is expected to publish official data for mortgage activity in December on 31 January.