IFM Investors, which has showcased its commitment to target net zero by 2050, has set a 2030 interim emissions reduction target of more than one million metric tons of CO2 for its infrastructure asset class.

This reflects an emissions reduction target of 40 per cent of IFM’s existing infrastructure portfolio from 2019 levels.

The fund manager, perhaps the most influential in the Australian capital market, has set a course that sits nearer the ‘Hot House World: Current Policies Scenario’ described by APRA on Friday in a cautious Climate Vulnerability Assessment.

Release of this document is a step in a process underway with Australia’s largest five banks.

The APRA CVA uses two climate scenarios as the foundation for assessing potential climate risk impacts on the banks. These climate scenarios set out different potential pathways for the evolution of the policy and physical climate environments between 2020 and 2050, and are aligned to the internationally accepted scenarios developed by the Network for Greening the Financial System.

The CVA is based on the climate-related risks associated with two of the NGFS Phase II scenarios, published in June 2021.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

Scenario 1 involves a delayed but then rapid reduction in emissions by 2050, while Scenario 2 is largely based on a continuation of current global policies and forecasts.

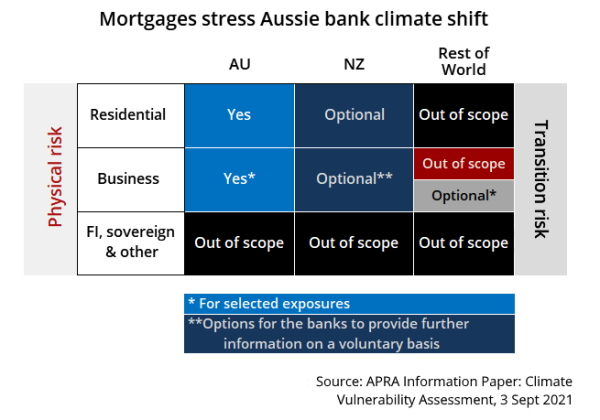

The CVA “focuses on transition and physical climate risks arising in Australia, or internationally with direct impact on Australian lending”.

Banks will be required to assess residential mortgages, corporate and business lending exposures, which account for approximately three quarters of their Australian lending exposure.

Assessment of New Zealand exposures, and broader international-based exposures, are optional, APRA said.

IFM Investors, meanwhile, says it will restrict investments in any assets that derive material amounts of revenue from thermal coal, while targeting zero coal exposure for its existing portfolio by 2030.

Last year, IFM committed to reducing greenhouse gas emissions across its asset classes, targeting net zero by 2050.

New acquisitions and asset management processes will consider “climate change transition and physical risks under reference scenarios, including 1.5 degree reference scenarios.

IFM will update “annual carbon footprint reporting by including disclosure on progress against IFM’s 2030 emissions reduction target, changes to portfolio level targets due to acquisitions and divestments, and updates on key emission reduction initiatives across the portfolio”.

The asset manager says further work is being undertaken on how IFM’s non-infrastructure asset classes will meet its net zero commitments, and this will form part of IFM’s overarching Climate Change Strategy to be released in coming months.