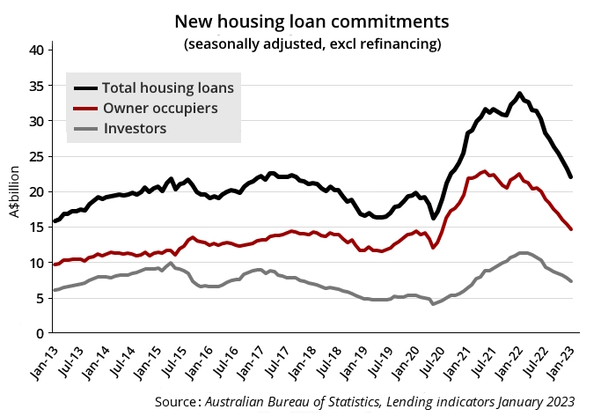

The A$22.05 billion of new lending for housing in January is down 35 per cent over 12 months, according to the latest Australian Bureau of Statistics lending data.

The value of new lending for housing has fallen every month since January last year.

New lending fell 5.3 per cent in January, compared with the previous month. New lending to owner occupiers was down 4.9 per cent month-on-month and down 35.1 per cent over 12 months.

New lending to residential property investors was down 6 per cent month-on-month and down 34.8 per cent over 12 months.

The value of external refinancing fell 2.1 per cent to $18.6 billion. The peak in the refinancing market was in November when $19.3 million of refinance was arranged.

Lending to first home buyers was $3.3 billion – down 7.4 per cent month-on-month and down 36.5 per cent over 12 months.

The number of first home buyer loans in January, at 6956, was down 57.5 per cent over 12 months.

The average new owner occupier loan size was $601,252 – down from $604,346 in December.

Reserve Bank data show that lenders’ mortgage balances grew by 0.3 per cent in January and by 6.1 per cent over the 12 months to January.

Owner occupier loan balances were up 0.4 per cent month-on-month and 6.6 per cent over 12 months.

Investor loan balances were up 0.2 per cent month-on-month and 5.1 per cent over 12 months.

APRA’s latest figures show that over the three months to January, ANZ and Commonwealth Bank grew their books ahead of system, while NAB and Westpac lost share.