The two-months’ worth of much anticipated industry data on loan deferrals produced by APRA late yesterday can only add to the belief there will be an early shift to macroprudential controls on bank lending in the mortgage market.

The top-line numbers seem ho-hum at first glance.

Total loan deferrals of A$11.9 billion represent all of 0.5 per cent of the $2.2 trillion in credit supplied by Australian banks.

Businesses broadly are clinging on rather than calling their banks for help - in the ‘hope, scream, survive’ mode alluded to by RBA governor Philip Lowe last month. Thus only 0.3 per cent of all SME loans ($765 million) are deferred.

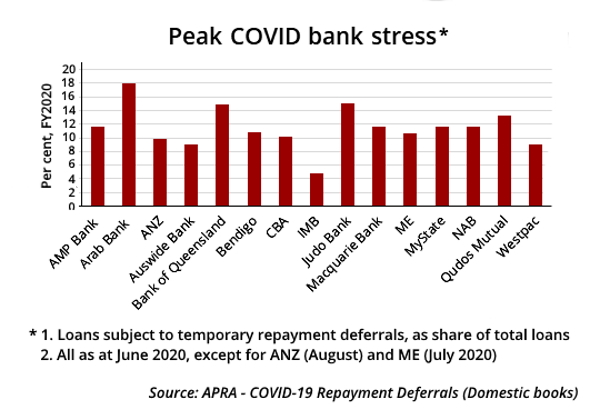

As the pandemic roared into a crisis 16 months ago, around 18 per cent of SME’s dived for deferrals. In the mortgage market, this ratio was in the order of 11 to 12 per cent.

At one tiny ADI last year, more than 50 per cent of borrowers either begged for (or maybe the board simply extended) deferrals help.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

This time around it’s the biggest names chasing each other for scrutiny, given the detail released by APRA on investment loans, interest only loans and high LVR loans as a share of housing deferrals.

Macquarie Bank’s super-charged and perhaps unprecedented acquisition of mortgage market share (discussed in a separate article in Banking Day today) may be interpreted, via this novel APRA series, as a warning of both an acceleration of declining credit quality at Macquarie itself and a wider warning for a range of agile, fast-growing banks - most of whom evaded exposure via this dragnet.

Investment loans as a share of housing deferrals were 45 per cent of the $405 million in total loans deferred by Macquarie. The average for the three big banks reported by APRA was 35 per cent.

For interest only loans as a share of housing deferrals, Macquarie is even more of an outlier, at 24 per cent, double the average for the other three. When Westpac led the banking pack with loose interest only lending some years ago, IO loans accounted for around 30 per cent all that bank's home loan funding.

In the high LVR stakes, Macquarie’s data have been “masked to maintain privacy” by APRA, a privilege also afforded AMP Bank broadly.

In the revival number of APRA’s ‘Temporary loan repayment deferrals due to COVID-19’ study (after a six-month break) the threshold for reporting has been lifted to those ADIs with $50 million and 50 facilities in loans subject to repayment deferral, compared to $20 million and 20 facilities in the ‘first round’.

This is the reason ANZ fell under the radar, and may be a function of ANZ’s mis-firing mortgage machine (reported in Banking Day on Wednesday, and again today).

The September 2021 issue will be released on 29 October 2021.

“As temporary loan repayment deferrals programs are coming to an end, APRA will consider the continuation of its statistical publication after the September 2021 edition,” they said.

Surely untrue on both counts.

Macquarie responds - Mortgage growth 'deliberate, strategic'

- From Ben Perham, Head of Personal Banking at Macquarie

The credit quality of Macquarie’s mortgage book is one of the strongest in the industry.

With 0.4% of home loans on COVID-19 payment pause, well below the industry average, Macquarie has deferred just 561 of more than 150,000 facilities at the request of clients due to the ongoing impacts of the pandemic.

Adding interest only deferrals to investor loan deferrals, without taking into account the fact that most investor facilities are also interest only, effectively double counts the numbers used.

Macquarie’s mortgage book growth has been driven by a deliberate, strategic focus on lower risk lending centred around the sub 80% loan to value ratio (LVR) lending tier.

In line with our focus on lower risk lending, Macquarie’s proportion of high LVR lending (defined by APRA in this context as lending above 90% LVR) is so low that the data has been excluded from the public APRA disclosures.