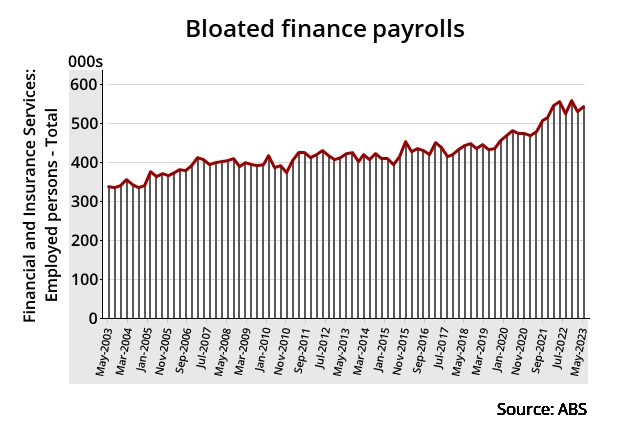

Employment numbers in banking, finance and insurance continue to weigh on the cost line of the industry.

Detailed labour force data released by the Australian Bureau of Statistics once again shows that any narrative around efficiency and productivity in the sector is hard to believe.

The ABS shows a whopping 544,000 people worked in financial services in Australia, as of May 2023 and, broadly speaking, these numbers continue to rise steadily.

Most employed in banking and finance find themselves working very, very long hours.

The proportion of employees in finance that worked more than 40 hours per week was 52.3 per cent in the May 2023 quarter, the ABS data shows, the highest level ever. This represented 284,000 people.

On the other hand, the proportion of finance employees working more than 50 hours a week has tapered off over the last couple of years. Possibly due to altered working arrangements thanks to Covid, this percentage spiked at 12.4 per cent in late 2021; it was around the 16 per cent mark a decade ago.

The ABS put this ratio at a shade under 10 per cent in the most recent quarter.

The overall picture painted by yesterday’s ABS labour force data on finance payrolls reinforces sector specific data from APRA, the banking and insurance regulator.

APRA’s latest quarterly ADI performance data put the ratio of employee costs to overall expenses over the year to March 2023 at 56.5 per cent, a ratio that’s been trending steadily up over recent years.

Total personnel expenses in the banking industry over the last year was $35 billion.